Home

Live Board Meeting

SCERS Board meetings take place in person and are also live-streamed via Zoom. Please check this page again on the morning of the next Board meeting for the streaming link. Thank you.

Latest News

SCERS Files Suit Against Tech Vendor

The Sacramento County Employees’ Retirement System (SCERS) filed a breach of contract lawsuit on April 19 in Sacramento Superior Court against Telus for failing to deliver a technological project.

Upcoming Retirement Health Care Planning Webinars for County Employees

Sacramento County Employee Benefits Office is offering webinars for employees and retirees to learn about Medicare health plan options; specifically:

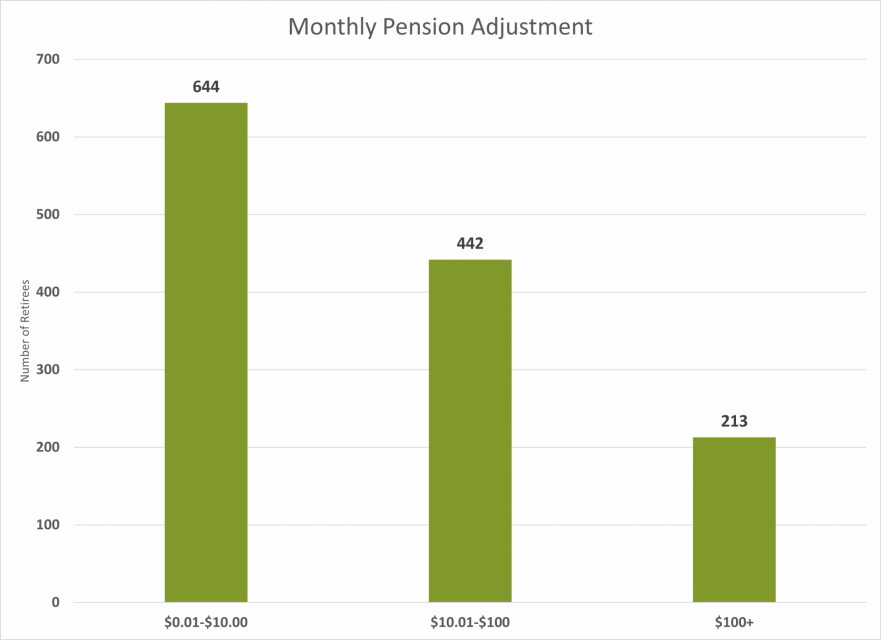

Alameda Corrections Completed

SCERS has concluded calculating the pension adjustments for County retirees that will occur on the March 2024 retirement allowance.

We are dedicated to providing the highest level of retirement services and managing system resources in an effective and prudent manner.

$12.4 Billion

Fund Size

13,167

Active Members

13,934

Retired Members

4,702

Deferred Members

As of June 30, 2023